Prepaid Rent Debit Or Credit

Prepaid Expenses

Future expenses that are paid in accelerate

What are Prepaid Expenses?

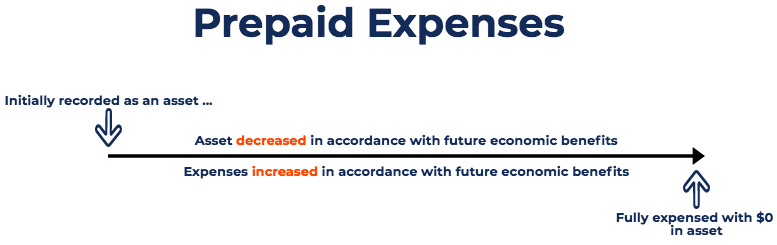

Prepaid expenses stand for expenditures that have not withal been recorded by a company as an expense, but have been paid for in advance. In other words, prepaid expenses are expenditures paid in one accounting period, only will non be recognized until a after accounting flow. Prepaid expenses are initially recorded as assets, considering they have hereafter economic benefits, and are expensed at the fourth dimension when the benefits are realized (the matching principle).

Summary

- Prepaid expenses are future expenses that are paid in advance and hence recognized initially equally an asset.

- Every bit the benefits of the expenses are recognized, the related asset account is decreased and expensed.

- The well-nigh common types of prepaid expenses are prepaid rent and prepaid insurance.

Common Reasons for Prepaid Expenses

The two most mutual uses of prepaid expenses are rent and insurance.

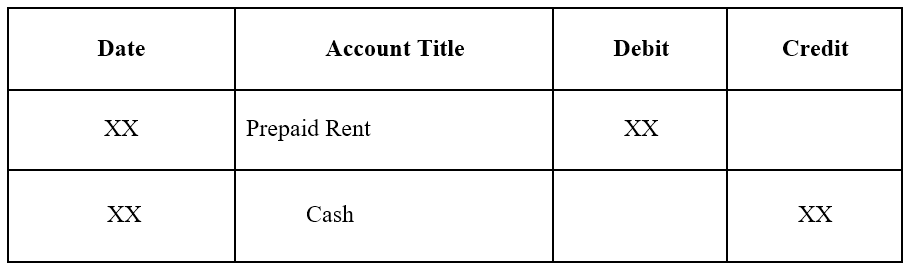

i. Prepaid rent is rent paid in advance of the rental period. The journal entries for prepaid rent are as follows:

Initial journal entry for prepaid rent:

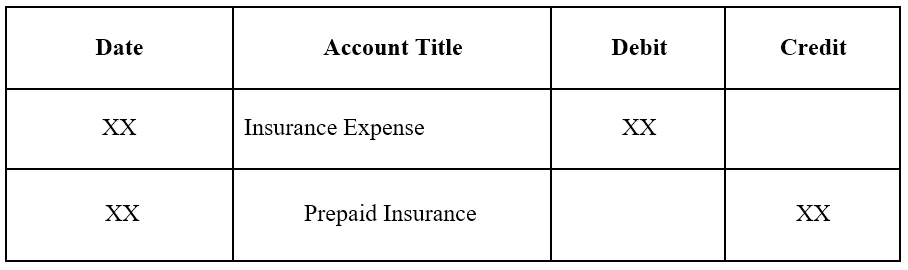

Adjusting journal entry equally the prepaid rent expires:

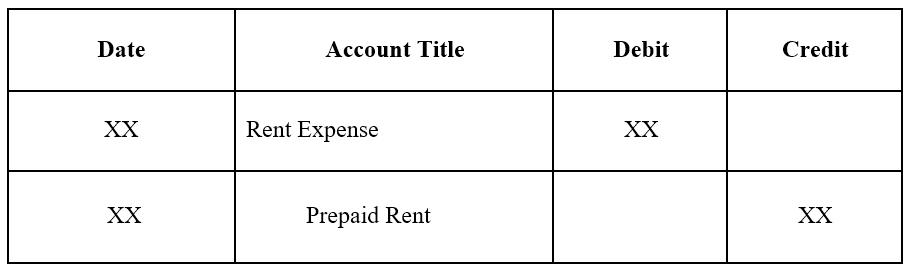

two. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet.

Initial journal entry for prepaid insurance:

Adjusting journal entry equally the prepaid insurance expires:

Prepaid Expenses Case

We will look at two examples of prepaid expenses:

Example #1

Company A signs a ane-year lease on a warehouse for $x,000 a month. The landlord requires that Visitor A pays the almanac amount ($120,000) upfront at the beginning of the year.

The initial journal entry for Visitor A would exist as follows:

At the end of ane month, Visitor A would've used upwardly one month of its lease agreement. Therefore, prepaid hire must be adjusted:

Note: 1 month corresponds to $ten,000 ($120,000 x 1/12) in rent.

The adjusting journal entry is washed each month, and at the cease of the year, when the lease agreement has no future economic benefits, the prepaid rent balance would be 0.

Case #2

Upon signing the one-yr charter agreement for the warehouse, the visitor besides purchases insurance for the warehouse. The company pays $24,000 in greenbacks upfront for a 12-month insurance policy for the warehouse.

The initial journal entry for Company A would be every bit follows:

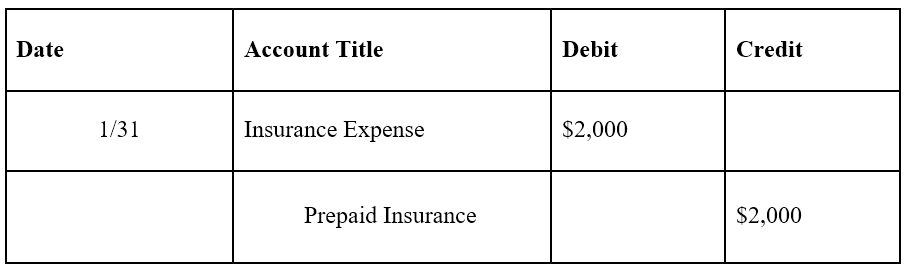

At the stop of i month, Company A would have used up one calendar month of its insurance policy. Therefore, prepaid insurance must be adapted:

Annotation: One calendar month corresponds to $2,000 ($24,000 x i/12) in insurance policy.

The adjusting journal entry is done each month, and at the end of the year, when the insurance policy has no future economical benefits, the prepaid insurance balance would exist 0.

Effect of Prepaid Expenses on Financial Statements

The initial journal entry for a prepaid expense does not impact a visitor'south financial statements. For example, refer to the commencement example of prepaid rent. The initial periodical entry for prepaid rent is a debit to prepaid hire and a credit to greenbacks.

These are both asset accounts and exercise non increase or decrease a company'due south balance sheet. Recall that prepaid expenses are considered an nugget because they provide future economic benefits to the company.

The adjusting journal entry for a prepaid expense, however, does affect both a company's income statement and residue sheet. Refer to the first example of prepaid rent. The adjusting entry on Jan 31 would result in an expense of $x,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent).

The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the avails on the balance sail past $10,000.

More Resource

Thank you for reading CFI'south guide to Prepaid Expenses. To keep learning and advancing your career, the post-obit CFI resources will be helpful:

- Toll Behavior Assay

- Cost Structure

- Fixed and Variable Costs

- Financial Accounting Theory

Prepaid Rent Debit Or Credit,

Source: https://corporatefinanceinstitute.com/resources/accounting/prepaid-expenses/

Posted by: ferrarifichalfic.blogspot.com

0 Response to "Prepaid Rent Debit Or Credit"

Post a Comment